Crypto Lending and Borrowing Trends

- The Rise of Crypto Lending Platforms

- Exploring the Benefits of Borrowing with Cryptocurrency

- Understanding the Risks Associated with Crypto Lending

- Emerging Trends in Decentralized Finance (DeFi) Lending

- The Role of Smart Contracts in Crypto Borrowing

- Regulatory Challenges in the Crypto Lending Industry

The Rise of Crypto Lending Platforms

The rise of crypto lending platforms has been a significant trend in the world of cryptocurrency. These platforms allow users to lend their digital assets to others in exchange for interest payments. This has opened up a whole new world of opportunities for investors looking to earn passive income on their crypto holdings.

One of the key advantages of crypto lending platforms is that they provide a way for holders of cryptocurrencies to put their assets to work without having to sell them. This can be particularly beneficial in a bull market, where prices are rising and investors may not want to miss out on potential gains.

Furthermore, crypto lending platforms often offer competitive interest rates compared to traditional financial institutions. This has attracted a growing number of users who are looking to maximize their returns on their crypto investments.

Exploring the Benefits of Borrowing with Cryptocurrency

Exploring the benefits of borrowing with cryptocurrency can provide individuals with a new way to access funds without going through traditional financial institutions. One of the main advantages of borrowing with cryptocurrency is the ability to secure a loan quickly and easily, without the need for a credit check or lengthy approval process. This can be especially beneficial for individuals who may not have a strong credit history or who are looking to access funds quickly.

Another benefit of borrowing with cryptocurrency is the potential for lower interest rates compared to traditional loans. Because cryptocurrency loans are often peer-to-peer, borrowers may be able to negotiate more favorable terms with lenders, resulting in lower overall costs. Additionally, borrowing with cryptocurrency can provide individuals with more flexibility in terms of loan terms and repayment options, allowing them to tailor the loan to their specific needs.

Furthermore, borrowing with cryptocurrency can also provide individuals with a level of privacy and security that may not be available with traditional loans. Cryptocurrency transactions are typically encrypted and decentralized, meaning that borrowers can access funds without having to disclose sensitive personal information. This can be particularly appealing for individuals who value their privacy and want to keep their financial transactions secure.

Understanding the Risks Associated with Crypto Lending

When considering crypto lending, it is crucial to understand the risks associated with this type of investment. While crypto lending can offer attractive returns, it is not without its challenges. One of the main risks is the volatility of the crypto market. Cryptocurrencies are known for their price fluctuations, which can result in losses for lenders.

Another risk to consider is the security of crypto lending platforms. Security breaches can lead to hackers gaining access to funds, putting investors at risk of financial loss. It is essential to thoroughly research lending platforms and choose reputable ones with a strong security track record.

Additionally, regulatory risks are a concern in the crypto lending space. Regulations surrounding cryptocurrencies are still evolving, and lenders may face compliance challenges in the future. It is important to stay informed about regulatory developments and ensure compliance with laws and regulations to mitigate risks.

Emerging Trends in Decentralized Finance (DeFi) Lending

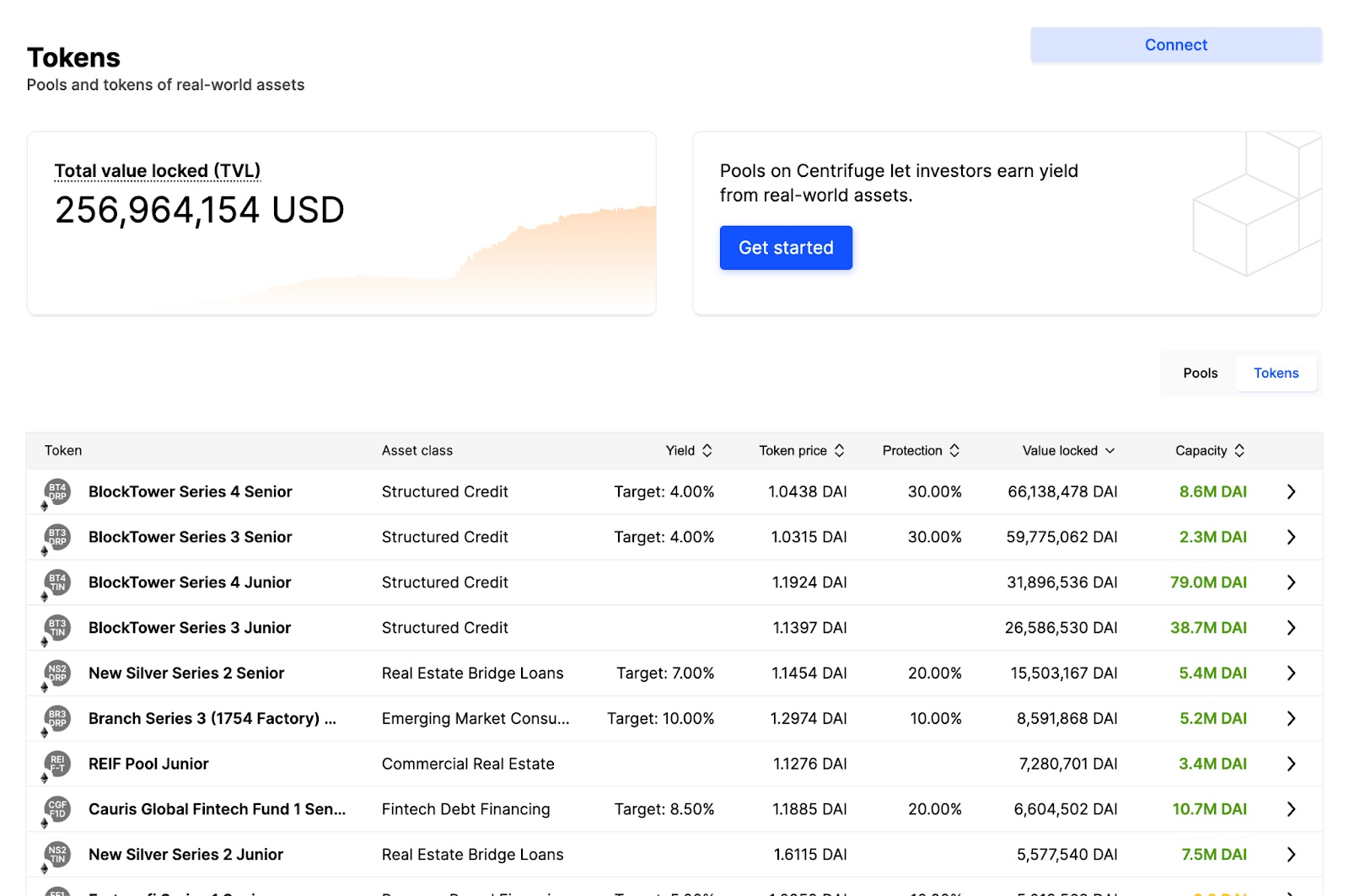

One of the emerging trends in decentralized finance (DeFi) lending is the rise of algorithmic lending protocols. These protocols use smart contracts to automate the lending process, eliminating the need for intermediaries and reducing costs for borrowers and lenders alike. This trend is gaining traction as more users seek out decentralized alternatives to traditional lending platforms.

Another trend in DeFi lending is the growing popularity of liquidity pools. These pools allow users to deposit their assets into a pool, which can then be used to fund loans for other users. In return, depositors earn interest on their assets. This trend is appealing to users looking to earn passive income on their crypto holdings.

Additionally, we are seeing an increase in the use of flash loans in DeFi lending. Flash loans are uncollateralized loans that must be repaid within a single transaction. These loans are popular among arbitrageurs and traders looking to take advantage of price differences across different platforms. This trend highlights the growing sophistication of DeFi lending products.

The Role of Smart Contracts in Crypto Borrowing

Smart contracts play a crucial role in the world of crypto borrowing, providing a secure and automated way for lenders and borrowers to interact without the need for intermediaries. These self-executing contracts are built on blockchain technology, ensuring transparency and trust in the lending process.

By using smart contracts, borrowers can access funds quickly and easily by collateralizing their crypto assets. This eliminates the need for traditional credit checks and paperwork, making the borrowing process more efficient and accessible to a wider range of individuals.

Additionally, smart contracts help to mitigate the risk for lenders by automatically enforcing the terms of the loan agreement. This reduces the potential for default and fraud, providing lenders with greater confidence in the lending process.

Overall, smart contracts have revolutionized the way in which crypto borrowing operates, offering a secure, efficient, and transparent solution for individuals looking to access funds using their crypto assets as collateral.

Regulatory Challenges in the Crypto Lending Industry

Regulatory challenges in the crypto lending industry are a significant concern for both lenders and borrowers. The lack of clear guidelines and regulations from government authorities has created uncertainty in the market. This ambiguity can lead to potential risks for participants in the industry, such as fraud, money laundering, and other illicit activities.

One of the main issues facing the crypto lending industry is the classification of digital assets. Different countries have varying definitions of cryptocurrencies, which can impact how they are regulated. Without a standardized approach, it is challenging for companies to navigate the legal landscape and ensure compliance with relevant laws.

Another challenge is the lack of consumer protection measures in place for crypto lending platforms. Unlike traditional financial institutions, these platforms may not offer the same level of security and insurance for users’ funds. This can make investors hesitant to participate in the market, limiting its growth potential.

Furthermore, the global nature of the crypto lending industry presents challenges for regulators. With transactions occurring across borders, it can be difficult to enforce regulations and monitor activities effectively. This can create opportunities for bad actors to take advantage of regulatory loopholes and engage in illegal activities.

In conclusion, regulatory challenges in the crypto lending industry must be addressed to ensure the long-term sustainability and legitimacy of the market. Clear guidelines and consumer protection measures are essential to foster trust among participants and promote responsible lending practices.