Fundamental Analysis of Crypto Projects

- Understanding the Basics of Fundamental Analysis in Crypto Projects

- Key Factors to Consider When Analyzing Crypto Projects

- The Importance of Team and Technology in Crypto Project Evaluation

- Analyzing Market Potential and Adoption for Crypto Projects

- Assessing the Tokenomics and Utility of Cryptocurrencies

- Case Studies: Applying Fundamental Analysis to Popular Crypto Projects

Understanding the Basics of Fundamental Analysis in Crypto Projects

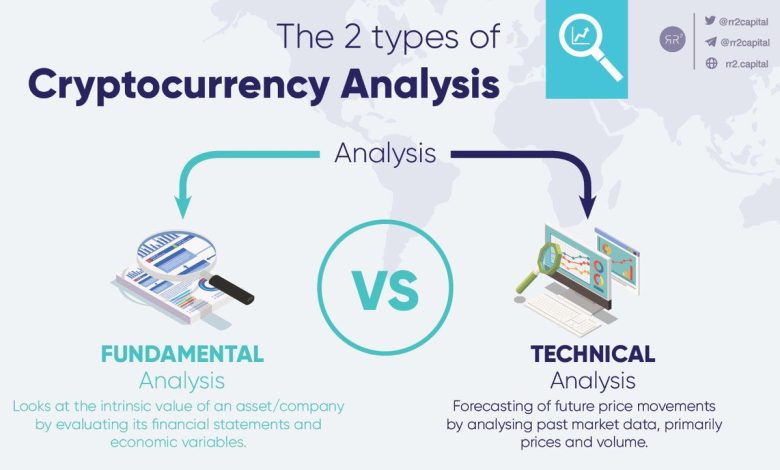

Fundamental analysis is a crucial aspect when evaluating crypto projects. It involves assessing the intrinsic value of a cryptocurrency by analyzing various factors that could impact its future performance. By understanding the basics of fundamental analysis, investors can make more informed decisions when choosing which crypto projects to invest in.

One key component of fundamental analysis is evaluating the team behind the project. A strong and experienced team is more likely to successfully execute the project and navigate any challenges that may arise. Investors should research the team’s background, track record, and expertise in the crypto space.

Another important factor to consider is the technology and innovation behind the project. Investors should assess the project’s technology stack, roadmap, and any unique selling points that set it apart from competitors. Understanding how the technology works and its potential for widespread adoption can help investors gauge the long-term viability of the project.

Furthermore, analyzing the market and competition is essential in fundamental analysis. Investors should evaluate the market demand for the project’s product or service, as well as the competitive landscape to determine how the project stacks up against other cryptocurrencies in the same space.

Overall, a thorough understanding of the basics of fundamental analysis in crypto projects can help investors make more informed decisions and mitigate risks associated with cryptocurrency investments. By considering factors such as the team, technology, market, and competition, investors can better assess the potential for growth and success of a crypto project.

Key Factors to Consider When Analyzing Crypto Projects

When analyzing crypto projects, there are several key factors to consider in order to make informed investment decisions. These factors can help you determine the potential for success and sustainability of a project in the long run.

One important factor to consider is the team behind the project. **The** team’s experience, expertise, and track record can give you valuable insights into their ability to execute the project successfully. **You** should also look at the team’s transparency and communication with the community, as this can indicate their commitment to the project’s success.

Another crucial factor to consider is the technology **used** by the project. **You** should assess the project’s underlying technology, such as its scalability, security, and decentralization. **This** will help **you** determine whether the project has the potential to solve real-world problems and gain widespread adoption.

Additionally, **you** should evaluate the project’s **market** fit and competition. **You** should assess whether the project addresses a **real** need in the market and how it differentiates itself from competitors. **This** will help **you** understand the project’s potential for growth and **sustainability** in a competitive market.

Furthermore, **you** should consider the project’s **community** and **adoption**. **A** strong and active community can help drive **the** project’s **growth** and **adoption**, as well as provide valuable feedback and support. **You** should also look at the project’s partnerships and collaborations, as these can **help** **you** gauge its credibility and potential for success.

In conclusion, analyzing crypto projects requires **a** comprehensive **approach** that takes into account **a** variety of factors. By considering **the** team, technology, market fit, competition, community, and adoption, **you** can make **more** informed investment decisions and **increase** your chances of **success** in the **crypto** market.

The Importance of Team and Technology in Crypto Project Evaluation

When conducting a fundamental analysis of crypto projects, it is crucial to consider the importance of both team and technology. The team behind a project plays a significant role in its success or failure. A strong and experienced team can navigate challenges, adapt to market conditions, and drive innovation. On the other hand, a team lacking in expertise or credibility may struggle to deliver on promises, leading to a loss of investor confidence.

Furthermore, technology is at the core of any crypto project. The underlying technology determines the project’s functionality, security, and scalability. Evaluating the technology stack, consensus mechanism, and smart contract capabilities can provide insights into the project’s potential for long-term success. Projects with robust and innovative technology are more likely to withstand market volatility and regulatory scrutiny.

By considering both the team and technology aspects of a crypto project, investors can make more informed decisions. A comprehensive evaluation that takes into account the expertise of the team members, their track record, and the technological capabilities of the project can help identify promising investment opportunities. Ultimately, a balanced approach that considers both team and technology is essential for assessing the viability and potential of crypto projects.

Analyzing Market Potential and Adoption for Crypto Projects

When analyzing the market potential and adoption for crypto projects, it is crucial to consider various factors that can influence their success. Understanding the demand for a particular project, as well as the level of competition in the market, can provide valuable insights into its potential for growth and adoption.

One key aspect to consider is the target market for the crypto project. Identifying the specific demographic or industry that the project aims to serve can help determine its potential for adoption. Additionally, assessing the current market trends and consumer behavior can provide valuable information on how receptive the market may be to the project.

Another important factor to consider is the technology behind the crypto project. Evaluating the project’s technical capabilities, security features, and scalability can help determine its potential for long-term success. Additionally, assessing the project’s team and their experience in the industry can provide insights into their ability to execute on the project’s goals.

Furthermore, analyzing the regulatory environment in which the crypto project operates is essential. Understanding the legal and compliance requirements can help mitigate risks and ensure the project’s long-term viability. Additionally, staying informed about any regulatory changes or developments can help anticipate potential challenges and opportunities for the project.

In conclusion, analyzing the market potential and adoption for crypto projects requires a comprehensive approach that takes into account various factors such as target market, technology, team, and regulatory environment. By carefully evaluating these factors, investors and stakeholders can make informed decisions about the potential success of a crypto project.

Assessing the Tokenomics and Utility of Cryptocurrencies

When conducting a fundamental analysis of crypto projects, it is crucial to assess the tokenomics and utility of the cryptocurrencies in question. Tokenomics refers to the economics of a token, including its distribution, supply, and demand dynamics. Understanding the tokenomics of a cryptocurrency can provide valuable insights into its potential for long-term success.

One key aspect to consider when evaluating tokenomics is the token distribution. A well-distributed token can help prevent centralization of power and control within the network. Additionally, a balanced token distribution can contribute to a more stable and secure ecosystem.

Another important factor to analyze is the token supply. A limited token supply can create scarcity, potentially driving up demand and value over time. On the other hand, an excessive token supply can lead to inflation and devaluation of the cryptocurrency.

Furthermore, assessing the utility of a cryptocurrency is essential in determining its long-term viability. Utility refers to the usefulness and functionality of the token within its ecosystem. A cryptocurrency with a clear use case and strong utility is more likely to attract users and investors.

Overall, evaluating the tokenomics and utility of cryptocurrencies is a critical step in conducting a comprehensive fundamental analysis of crypto projects. By understanding these key factors, investors can make more informed decisions and identify promising investment opportunities in the ever-evolving world of cryptocurrencies.

Case Studies: Applying Fundamental Analysis to Popular Crypto Projects

When it comes to applying fundamental analysis to popular crypto projects, there are several case studies that can provide valuable insights. By examining the underlying factors that drive the value of these projects, investors can make more informed decisions about where to allocate their resources.

One such case study is the analysis of Ethereum, the second-largest cryptocurrency by market capitalization. By looking at factors such as the technology behind Ethereum, the team of developers working on the project, and the overall market demand for decentralized applications, investors can gain a better understanding of the long-term potential of this project.

Another interesting case study is the evaluation of Binance Coin, the native token of the Binance cryptocurrency exchange. By examining factors such as the utility of the token within the Binance ecosystem, the company’s track record of innovation, and the overall growth of the exchange, investors can assess whether Binance Coin is a sound investment.

Finally, a third case study worth considering is the analysis of Cardano, a blockchain platform that aims to provide a more secure and scalable infrastructure for the development of decentralized applications. By looking at factors such as the team behind Cardano, the technology they are developing, and the partnerships they have formed, investors can determine whether Cardano has the potential to disrupt the blockchain industry.