Current Trends in the Cryptocurrency Market

- The Rise of Decentralized Finance (DeFi)

- Impact of Institutional Investors on Cryptocurrency Prices

- Emergence of Non-Fungible Tokens (NFTs) in the Market

- Regulatory Challenges Facing the Cryptocurrency Industry

- Growing Popularity of Stablecoins as a Hedge Against Volatility

- The Role of Cryptocurrency Exchanges in Shaping Market Trends

The Rise of Decentralized Finance (DeFi)

The rise of decentralized finance (DeFi) has been one of the most significant trends in the cryptocurrency market in recent years. DeFi refers to a movement that aims to create a more open and accessible financial system by leveraging blockchain technology. This trend has gained momentum as more people seek alternatives to traditional financial institutions.

DeFi platforms allow users to access a wide range of financial services, such as lending, borrowing, and trading, without the need for intermediaries. This decentralized approach offers greater transparency, security, and control over one’s assets. As a result, DeFi has attracted a growing number of users and investors looking to participate in this innovative ecosystem.

One of the key features of DeFi is the use of smart contracts, which are self-executing contracts with the terms of the agreement directly written into code. These smart contracts automate processes and remove the need for trust between parties, making transactions more efficient and secure. This technology has enabled the development of various DeFi applications, including decentralized exchanges, lending protocols, and yield farming platforms.

Impact of Institutional Investors on Cryptocurrency Prices

In recent years, the **impact** of institutional investors on **cryptocurrency** prices has become increasingly significant. These **investors** bring a level of **credibility** and **stability** to the **market** that was previously lacking. As a result, their **influence** on **cryptocurrency** prices cannot be understated.

One of the key ways in which institutional investors affect **cryptocurrency** prices is through their **buying** and **selling** **activities**. When **institutional** **investors** **purchase** large amounts of a particular **cryptocurrency**, it can **drive** up the **price** due to **increased** **demand**. Conversely, when they **sell** off their **holdings**, it can **lead** to a **drop** in **price**.

Another **way** in which institutional investors impact **cryptocurrency** prices is through their **participation** in **initial** **coin** **offerings** (ICOs). By **investing** in these **projects**, **institutional** **investors** can **help** **fund** their **development**, which can **ultimately** **affect** the **value** of the **cryptocurrency** being **offered**.

Furthermore, the **entry** of **institutional** **investors** into the **cryptocurrency** **market** can **lead** to **increased** **regulation** and **oversight**. This can **help** **legitimize** the **industry** and **attract** more **mainstream** **investors**, which can **contribute** to **price** **stability**.

Overall, the **impact** of institutional investors on **cryptocurrency** prices is undeniable. Their **influence** is **reshaping** the **market** and **bringing** a new level of **maturity** to the **industry**. As **institutional** **investors** continue to **enter** the **space**, it will be **interesting** to see how their **actions** **affect** **prices** in the **long** **term**.

Emergence of Non-Fungible Tokens (NFTs) in the Market

The emergence of Non-Fungible Tokens (NFTs) has been a significant trend in the cryptocurrency market in recent years. NFTs are unique digital assets that represent ownership of a particular item or piece of content, such as art, music, or collectibles. Unlike cryptocurrencies like Bitcoin or Ethereum, which are fungible and can be exchanged on a one-to-one basis, NFTs are indivisible and cannot be exchanged for an equal value.

NFTs have gained popularity due to their ability to provide proof of ownership and authenticity for digital assets, making them valuable to creators and collectors alike. The use of blockchain technology ensures the security and immutability of NFT transactions, giving buyers confidence in the legitimacy of their purchases.

As NFTs continue to make waves in the market, they have opened up new opportunities for artists, musicians, and other creators to monetize their work in innovative ways. The ability to tokenize digital assets and sell them as NFTs has created a new revenue stream for content creators, allowing them to reach a global audience and connect directly with their fans.

Regulatory Challenges Facing the Cryptocurrency Industry

The cryptocurrency industry is currently facing a number of regulatory challenges that are impacting its growth and stability. **Regulations** vary from country to country, with some governments embracing cryptocurrencies while others are taking a more cautious approach. This lack of uniformity in regulations has created uncertainty for investors and businesses operating in the cryptocurrency space.

One of the main regulatory challenges facing the cryptocurrency industry is the issue of **compliance**. Many governments are concerned about the potential for cryptocurrencies to be used for illegal activities such as money laundering and tax evasion. As a result, they are implementing strict **compliance** measures that require cryptocurrency exchanges and other businesses to adhere to anti-money laundering (AML) and know your customer (KYC) regulations.

Another regulatory challenge facing the cryptocurrency industry is the lack of clarity around **taxation**. Governments are still figuring out how to tax cryptocurrencies, which has created confusion for investors and businesses. Some countries treat cryptocurrencies as **assets**, subjecting them to capital gains tax, while others treat them as **currencies**, subjecting them to income tax.

Additionally, the issue of **consumer protection** is a major concern in the cryptocurrency industry. Due to the decentralized and **anonymous** nature of cryptocurrencies, consumers are at risk of fraud and scams. Governments are working to implement regulations that protect consumers from these risks, such as requiring exchanges to have proper security measures in place and ensuring that investors are aware of the risks involved in investing in cryptocurrencies.

Overall, the regulatory challenges facing the cryptocurrency industry are complex and multifaceted. As the industry continues to evolve, it will be important for governments to work together to create **harmonized** regulations that protect consumers while also allowing for innovation and growth in the cryptocurrency market.

Growing Popularity of Stablecoins as a Hedge Against Volatility

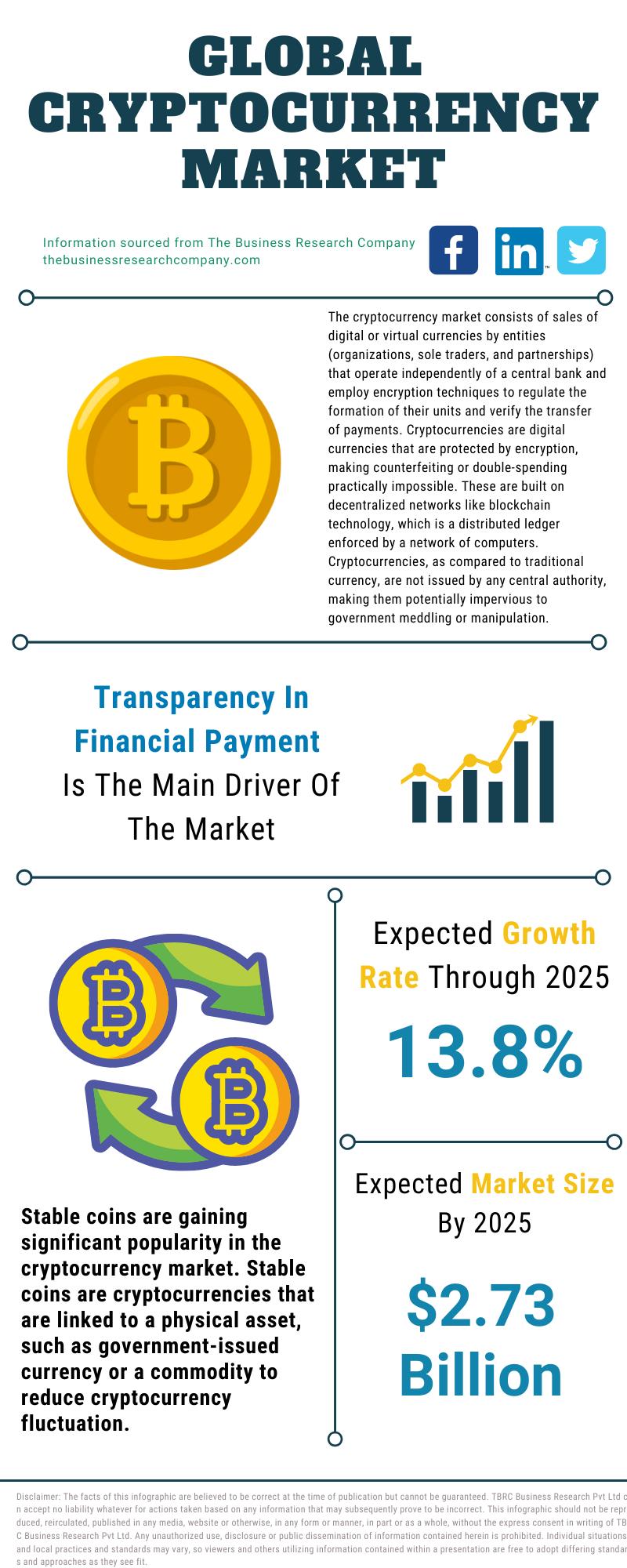

The growing popularity of stablecoins as a hedge against volatility in the cryptocurrency market is becoming increasingly evident. Investors are turning to stablecoins as a way to protect their investments from the unpredictable price fluctuations that are common in the world of digital assets.

Stablecoins are digital currencies that are pegged to a stable asset, such as the US dollar or gold. This pegging mechanism helps to minimize the volatility that is inherent in other cryptocurrencies like Bitcoin and Ethereum. As a result, stablecoins provide a more secure store of value for investors looking to safeguard their funds.

One of the main reasons for the rise in popularity of stablecoins is their ability to offer stability in times of market turbulence. When the price of traditional cryptocurrencies is experiencing wild swings, stablecoins provide a safe haven for investors to park their funds until the storm passes.

Furthermore, stablecoins are also being used as a means of conducting transactions within the cryptocurrency ecosystem. Their stable value makes them an attractive option for buying and selling goods and services, as both parties can be confident that the value of the stablecoin will remain relatively constant.

Overall, the increasing adoption of stablecoins as a hedge against volatility is a clear indication of the maturation of the cryptocurrency market. As investors seek out more stable and secure options for their digital assets, stablecoins are likely to continue gaining traction in the years to come.

The Role of Cryptocurrency Exchanges in Shaping Market Trends

Cryptocurrency exchanges play a crucial role in shaping market trends within the digital asset space. These platforms serve as the primary marketplace where traders can buy and sell various cryptocurrencies, influencing the supply and demand dynamics that drive price movements.

One key way in which cryptocurrency exchanges impact market trends is through the listing of new digital assets. When a popular exchange decides to add a new cryptocurrency to its platform, it can generate significant interest from traders looking to invest in the asset. This increased demand can lead to price appreciation and heightened market activity for the newly listed coin.

Moreover, the trading volume on cryptocurrency exchanges can also provide valuable insights into market trends. High trading volumes for a particular cryptocurrency may indicate increased interest and activity surrounding that asset, potentially signaling a bullish trend. Conversely, low trading volumes could suggest waning interest and a possible bearish trend.

Additionally, the presence of arbitrage opportunities on cryptocurrency exchanges can influence market trends by helping to align prices across different platforms. Traders can take advantage of price discrepancies between exchanges by buying low on one platform and selling high on another, ultimately contributing to price convergence and market efficiency.

Overall, cryptocurrency exchanges serve as the backbone of the digital asset market, facilitating the buying and selling of cryptocurrencies while also playing a significant role in shaping market trends through listings, trading volumes, and arbitrage opportunities. Understanding the impact of exchanges on market dynamics is essential for traders and investors looking to navigate the ever-evolving cryptocurrency landscape.