Comparing Crypto Market Trends with Traditional Markets

- Understanding the volatility of cryptocurrency vs traditional markets

- Analyzing the impact of global events on crypto and traditional markets

- The role of regulations in shaping the future of crypto and traditional markets

- Exploring the investor sentiment in cryptocurrency and traditional markets

- Comparing the liquidity of cryptocurrency and traditional markets

- The potential for growth and innovation in crypto markets compared to traditional markets

Understanding the volatility of cryptocurrency vs traditional markets

Cryptocurrency and traditional markets exhibit varying degrees of volatility, with each having its unique characteristics. **Understanding** the differences between the two can help investors make informed decisions when navigating these markets.

In the realm of cryptocurrency, **volatility** is a common occurrence due to factors such as market sentiment, regulatory developments, and technological advancements. The decentralized nature of cryptocurrencies can lead to rapid price fluctuations, making it a high-risk, high-reward investment option.

On the other hand, traditional markets like stocks and bonds tend to be more stable, with **volatility** typically driven by economic indicators, geopolitical events, and company performance. While traditional markets may experience fluctuations, they are often less extreme compared to the crypto market.

Investors should consider their risk tolerance and investment goals when deciding between cryptocurrency and traditional markets. **Diversifying** a portfolio with a mix of both can help mitigate risk and take advantage of opportunities in different market conditions.

Ultimately, **understanding** the volatility of cryptocurrency versus traditional markets is essential for investors looking to navigate the ever-changing landscape of the financial world. By staying informed and being aware of the unique characteristics of each market, investors can make sound decisions to achieve their financial objectives.

Analyzing the impact of global events on crypto and traditional markets

When it comes to analyzing the impact of global events on crypto and traditional markets, it is essential to consider how different factors can influence the trends in both sectors. Global events such as economic crises, political instability, and natural disasters can have a significant effect on the crypto market as well as traditional markets like stocks and commodities.

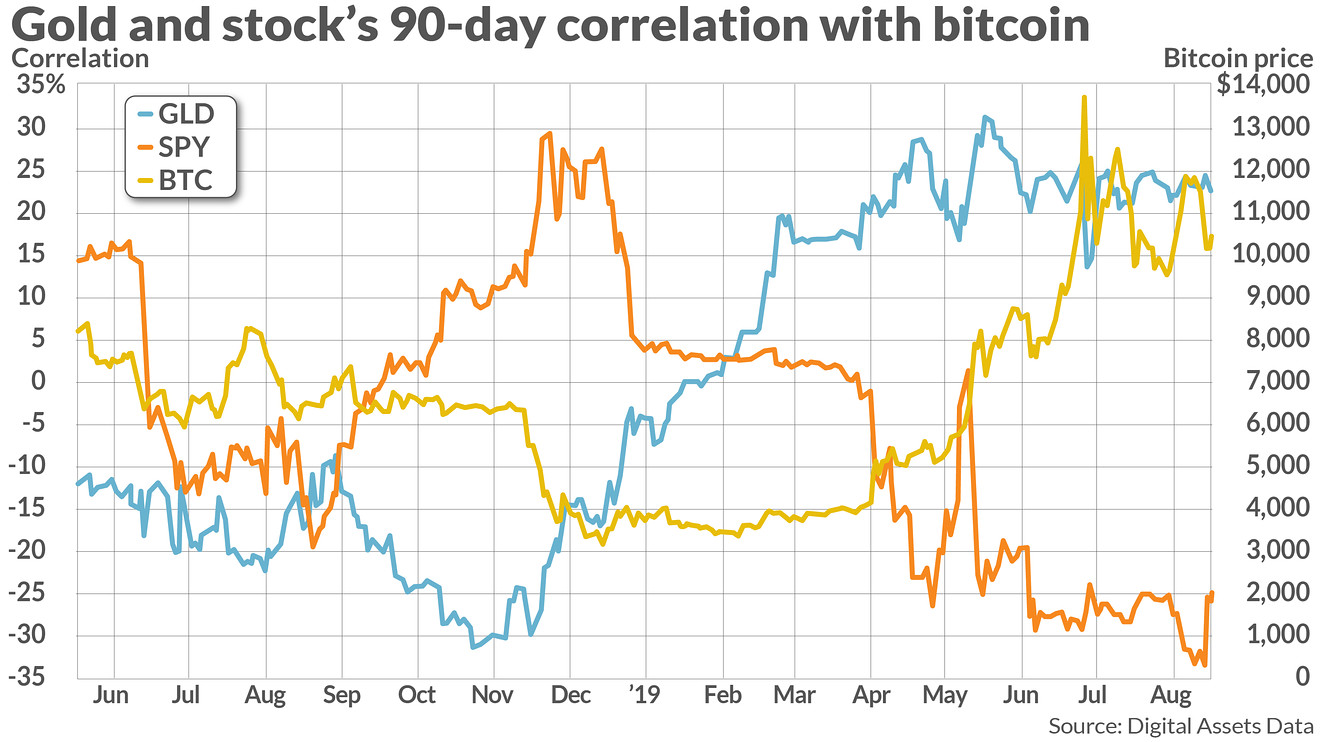

One key difference between the two markets is their level of correlation with global events. While traditional markets are often more directly impacted by events such as interest rate changes or geopolitical tensions, the crypto market can sometimes be more insulated from these factors. This is because cryptocurrencies are decentralized and not tied to any specific government or financial institution.

However, this does not mean that the crypto market is immune to global events. For example, during times of economic uncertainty, investors may flock to cryptocurrencies as a safe haven asset, driving up prices. On the other hand, regulatory crackdowns or security breaches can cause crypto prices to plummet.

It is important for investors to carefully monitor global events and their potential impact on both crypto and traditional markets. By staying informed and being aware of market trends, investors can make more informed decisions about their investments and mitigate risks associated with market volatility.

The role of regulations in shaping the future of crypto and traditional markets

Regulations play a crucial role in shaping the future of both crypto and traditional markets. **Government** oversight and compliance requirements can impact the **development** and growth of these markets in significant ways. In the crypto market, regulations are still evolving as **regulators** strive to keep up with the fast-paced nature of digital currencies. On the other hand, traditional markets have long-established regulatory frameworks that provide stability and **security** for investors.

In the crypto market, regulations can affect **market** sentiment and **investment** decisions. Uncertainty around regulatory **compliance** can lead to volatility in prices and hinder mainstream adoption of cryptocurrencies. However, clear and **enforceable** regulations can provide **investors** with confidence and help legitimize the market. In traditional markets, regulations are designed to protect investors, ensure **fairness**, and maintain market integrity.

As both markets continue to evolve, regulators face the challenge of striking a balance between **innovation** and investor protection. In the crypto market, regulators are exploring ways to prevent **fraud** and money laundering while still allowing for **innovation** and growth. In traditional markets, regulators are adapting to technological advancements and the rise of **algorithmic** trading.

Overall, regulations will continue to play a crucial role in shaping the future of both crypto and traditional markets. **Investors** and market participants must stay informed about regulatory developments and adapt their strategies accordingly. By **complying** with regulations and promoting transparency, both markets can thrive and attract a broader range of investors. Ultimately, a well-regulated market is essential for long-term **sustainability** and growth.

Exploring the investor sentiment in cryptocurrency and traditional markets

Investor sentiment plays a crucial role in both cryptocurrency and traditional markets. Understanding how investors feel about the market can provide valuable insights into potential trends and movements. In the cryptocurrency market, sentiment is often driven by factors such as regulatory news, technological advancements, and market speculation. On the other hand, traditional markets are influenced by economic indicators, geopolitical events, and company performance.

In the cryptocurrency market, investor sentiment can be highly volatile, with prices often fluctuating based on news and social media trends. This can create opportunities for traders to capitalize on market movements. In contrast, traditional markets tend to be more stable, with investor sentiment influenced by long-term economic factors and company fundamentals.

Comparing the sentiment in both markets can help investors make informed decisions about where to allocate their capital. By analyzing trends in both cryptocurrency and traditional markets, investors can gain a better understanding of overall market sentiment and potential investment opportunities. It is essential to consider the unique characteristics of each market when evaluating investor sentiment and making investment decisions.

Comparing the liquidity of cryptocurrency and traditional markets

When comparing the liquidity of cryptocurrency and traditional markets, it is important to consider the differences in how these markets operate. Cryptocurrency markets are known for their high volatility and rapid price movements, which can lead to increased liquidity compared to traditional markets. This is due to the fact that cryptocurrencies are traded 24/7 on various exchanges around the world, allowing for continuous buying and selling opportunities.

On the other hand, traditional markets such as stocks and commodities are typically only traded during specific hours, which can limit liquidity during off-hours. Additionally, traditional markets are subject to regulations and restrictions that can impact liquidity, whereas cryptocurrency markets are often decentralized and operate with fewer barriers to entry.

Overall, while both cryptocurrency and traditional markets offer opportunities for liquidity, the nature of cryptocurrency markets can provide a more dynamic and fast-paced trading environment for investors looking to capitalize on market trends.

The potential for growth and innovation in crypto markets compared to traditional markets

When comparing the potential for growth and innovation in crypto markets with traditional markets, it is evident that cryptocurrency offers a unique opportunity for investors. The crypto market operates 24/7, allowing for continuous trading and investment opportunities, unlike traditional markets that have set operating hours. This constant availability in the crypto market can lead to faster growth and increased liquidity.

Furthermore, the decentralized nature of cryptocurrencies eliminates the need for intermediaries, reducing transaction costs and increasing efficiency. This can attract more investors to the crypto market due to lower barriers to entry. Additionally, the use of blockchain technology in cryptocurrencies provides transparency and security, which can build trust among investors.

Moreover, the crypto market is known for its high volatility, which can be seen as a risk by some investors but also as an opportunity for significant returns. This volatility can lead to rapid price movements, creating opportunities for traders to profit. In contrast, traditional markets tend to have lower volatility, which may limit the potential for high returns.

In conclusion, the crypto market offers a dynamic and innovative environment for investors, with the potential for rapid growth and high returns. While traditional markets have their advantages, such as stability and regulation, the crypto market presents unique opportunities that can attract a new wave of investors looking to capitalize on the future of finance.