The Influence of Mining on Crypto Prices

- The correlation between mining activities and cryptocurrency prices

- Impact of mining difficulty on the value of cryptocurrencies

- How mining rewards affect the market value of digital assets

- The role of mining pools in shaping the price of cryptocurrencies

- Environmental concerns surrounding cryptocurrency mining and its effect on prices

- The future of crypto prices in relation to the mining industry

The correlation between mining activities and cryptocurrency prices

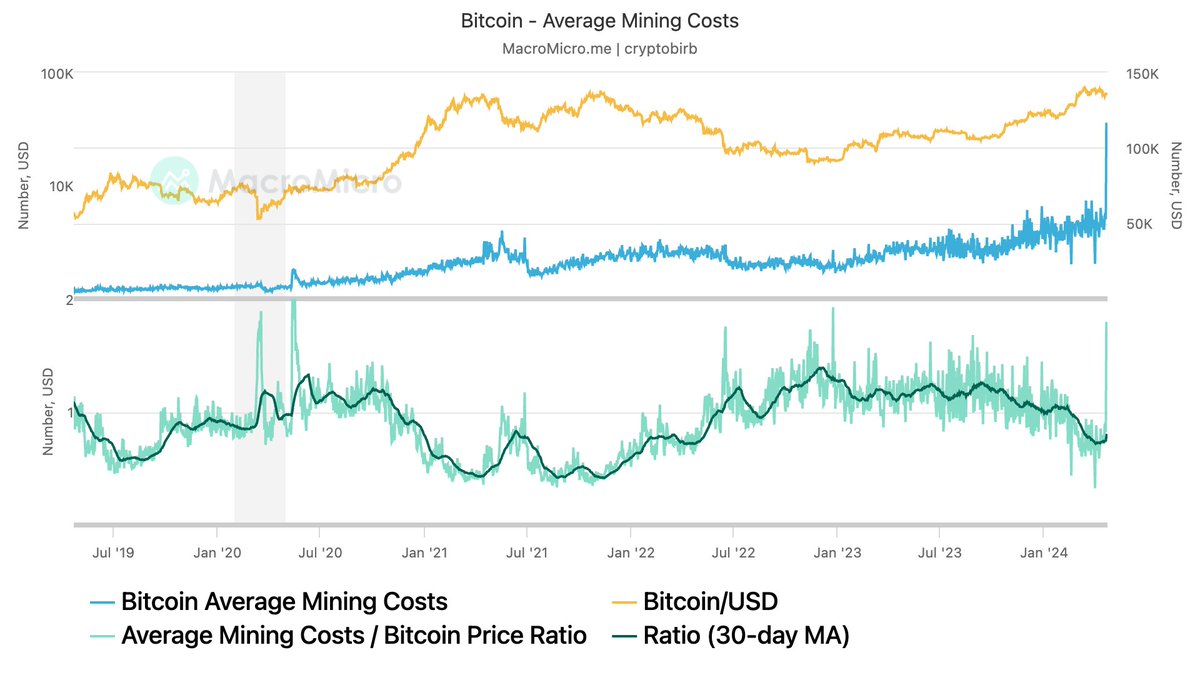

There is a strong correlation between mining activities and cryptocurrency prices. As more miners join the network, the competition for block rewards increases, leading to higher prices for cryptocurrencies. Conversely, when mining becomes less profitable, miners may choose to sell off their holdings, causing prices to drop.

Miners play a crucial role in maintaining the security and integrity of blockchain networks. Their computational power is essential for processing transactions and securing the network against potential attacks. As a result, fluctuations in mining activities can have a significant impact on the overall health of the cryptocurrency market.

It is important to note that mining activities are influenced by various factors, including the cost of electricity, hardware prices, and regulatory environment. These external factors can affect the profitability of mining operations and, in turn, influence cryptocurrency prices.

Impact of mining difficulty on the value of cryptocurrencies

Mining difficulty plays a crucial role in determining the value of cryptocurrencies. As the difficulty of mining increases, it becomes more challenging for miners to validate transactions and create new blocks in the blockchain. This leads to a decrease in the supply of the cryptocurrency, which can drive up its value. Conversely, when mining difficulty decreases, it becomes easier for miners to generate new coins, increasing the supply and potentially lowering the value of the cryptocurrency.

Investors closely monitor changes in mining difficulty as it can provide valuable insights into the future price movements of a cryptocurrency. A significant increase in mining difficulty may signal increased demand for the cryptocurrency, leading to a potential price surge. On the other hand, a decrease in mining difficulty could indicate a lack of interest in the cryptocurrency, potentially resulting in a price drop.

It is essential for investors to consider the impact of mining difficulty when making decisions about buying or selling cryptocurrencies. By staying informed about changes in mining difficulty and understanding how it can influence prices, investors can make more informed decisions and potentially capitalize on market trends.

How mining rewards affect the market value of digital assets

Mining rewards play a significant role in influencing the market value of digital assets. When miners successfully validate transactions on a blockchain network, they are rewarded with newly minted coins as well as transaction fees. This process of mining helps to secure the network and maintain the integrity of the blockchain.

The issuance of new coins as mining rewards can impact the supply and demand dynamics of a particular cryptocurrency. As more coins are introduced into circulation through mining, it can lead to inflation if the demand does not keep pace with the increased supply. Conversely, a decrease in mining rewards can create scarcity and drive up the value of a digital asset.

Investors and traders closely monitor the mining rewards of different cryptocurrencies as part of their fundamental analysis. Changes in mining rewards can signal shifts in the underlying economics of a blockchain network, which in turn can affect the perceived value of a digital asset. This information can inform trading decisions and help market participants anticipate price movements.

The role of mining pools in shaping the price of cryptocurrencies

One crucial aspect to consider when examining the impact of mining on cryptocurrency prices is the role of mining pools. Mining pools play a significant role in shaping the price of cryptocurrencies due to their collective mining power and influence on the network.

When miners join forces in a mining pool, they combine their computational resources to increase the chances of successfully mining a block. This pooling of resources allows them to compete more effectively against larger mining operations and increases their overall profitability.

Furthermore, mining pools can also have a direct impact on the supply of cryptocurrencies in the market. As mining pools collectively mine new coins, they are responsible for introducing them into circulation. This influx of new coins can affect the overall supply and demand dynamics, ultimately influencing the price of the cryptocurrency.

Additionally, the decisions made by mining pools, such as which cryptocurrencies to mine and when to sell newly minted coins, can also have a significant impact on price movements. By coordinating their actions, mining pools can potentially manipulate prices or exacerbate market volatility.

Overall, mining pools play a crucial role in shaping the price of cryptocurrencies through their collective mining power, influence on the supply of coins, and potential for market manipulation. Understanding the dynamics of mining pools is essential for gaining insights into the broader factors that influence cryptocurrency prices.

Environmental concerns surrounding cryptocurrency mining and its effect on prices

One of the major environmental concerns surrounding cryptocurrency mining is the significant amount of energy consumption required to power the mining process. The process of mining cryptocurrencies such as Bitcoin and Ethereum involves solving complex mathematical problems that require high computational power. As a result, miners often rely on powerful computer systems that consume a large amount of electricity. This has raised concerns about the environmental impact of cryptocurrency mining, particularly in terms of carbon emissions and energy consumption.

Furthermore, the increasing popularity of cryptocurrency mining has led to a surge in demand for energy, which has put a strain on local power grids and infrastructure. In some cases, cryptocurrency mining operations have been known to consume more electricity than entire countries. This has led to concerns about the sustainability of cryptocurrency mining and its long-term impact on the environment.

Another environmental concern surrounding cryptocurrency mining is the issue of electronic waste. As miners upgrade their hardware to keep up with the increasing complexity of mining algorithms, older equipment is often discarded and ends up in landfills. This has raised concerns about the environmental impact of e-waste and the need for responsible disposal and recycling practices within the cryptocurrency mining industry.

The future of crypto prices in relation to the mining industry

When considering the future of cryptocurrency prices in relation to the mining industry, it is essential to understand the significant impact that mining operations have on the overall market. The process of mining plays a crucial role in determining the supply of cryptocurrencies, which in turn affects their prices. As more coins are mined, the supply increases, potentially leading to a decrease in prices due to oversaturation in the market.

On the other hand, the cost of mining also influences crypto prices. If the cost of mining a particular cryptocurrency is high, miners may be inclined to hold onto their coins until prices rise to cover their expenses. This behavior can create scarcity in the market, driving prices up. Conversely, if mining becomes more affordable, miners may sell off their coins more readily, leading to a decrease in prices.

Furthermore, the technological advancements in the mining industry can also impact crypto prices. As mining equipment becomes more efficient, miners can increase their output, potentially flooding the market with new coins and driving prices down. Conversely, if mining technology lags behind, it may limit the supply of new coins, leading to price increases due to scarcity.

In conclusion, the future of crypto prices is intricately linked to the mining industry. Factors such as supply and demand dynamics, mining costs, and technological advancements all play a role in determining the value of cryptocurrencies. By closely monitoring developments in the mining sector, investors can gain valuable insights into potential price movements in the crypto market.