Crypto Market Cycles: Bull and Bear Trends

- Understanding the Crypto Market Cycles

- Exploring the Dynamics of Bull Trends in Crypto Markets

- Navigating the Volatility of Bear Trends in Cryptocurrency

- Analyzing the Impact of Market Sentiment on Crypto Cycles

- Strategies for Profiting from Bull and Bear Trends in Cryptocurrency

- Predicting Future Market Trends in the Crypto Industry

Understanding the Crypto Market Cycles

Understanding the crypto market cycles is crucial for investors looking to navigate the volatile world of cryptocurrency trading. These cycles typically consist of two main trends: bull and bear markets. **Bull** markets are characterized by rising prices and investor optimism, while **bear** markets see declining prices and increased pessimism.

During a bull market, investors are more willing to take risks and invest in cryptocurrencies, driving prices higher. This positive sentiment can create a self-reinforcing cycle as more investors jump on the bandwagon, further boosting prices. However, it’s important to note that bull markets are not sustainable in the long term, and eventually, the market will enter a bear phase.

In a bear market, prices fall, and investor confidence wanes. This can lead to panic selling as investors rush to cut their losses. While bear markets can be challenging for investors, they also present opportunities for those willing to take a contrarian approach and buy assets at discounted prices. It’s essential to remain patient and disciplined during bear markets, as they are a natural part of the market cycle.

Overall, understanding the dynamics of bull and bear markets is essential for navigating the crypto market successfully. By recognizing the signs of each phase and adjusting your investment strategy accordingly, you can position yourself to capitalize on market trends and protect your assets during periods of volatility.

Exploring the Dynamics of Bull Trends in Crypto Markets

Exploring the dynamics of bull trends in crypto markets can provide valuable insights into the behavior of digital assets during periods of price appreciation. Bull trends are characterized by sustained upward movement in prices, often driven by positive market sentiment and increasing demand from investors. Understanding the factors that contribute to the formation and continuation of bull trends can help traders and investors make informed decisions in the volatile crypto market.

One key aspect of bull trends is the concept of market cycles, where prices go through phases of expansion and contraction. During bull markets, prices tend to rise steadily over an extended period, creating opportunities for traders to profit from the upward momentum. By identifying the stages of a bull trend, such as accumulation, uptrend, and distribution, traders can better anticipate price movements and adjust their strategies accordingly.

Technical analysis plays a crucial role in analyzing bull trends, as it involves studying historical price data and chart patterns to identify potential entry and exit points. Indicators such as moving averages, relative strength index (RSI), and Fibonacci retracement levels can help traders gauge the strength of a bull trend and make informed decisions about when to buy or sell assets. By combining technical analysis with fundamental research, traders can gain a comprehensive understanding of the market dynamics driving bull trends in the crypto space.

Navigating the Volatility of Bear Trends in Cryptocurrency

Navigating the volatility of **bear trends** in cryptocurrency can be a challenging task for investors and traders alike. During these periods, prices tend to **decline** steadily, causing panic and uncertainty in the market. However, there are strategies that can be employed to **mitigate** losses and even capitalize on opportunities that arise during bear markets.

One approach to navigating bear trends is to **diversify** your portfolio. By spreading your investments across different **assets**, you can reduce the impact of a downturn in any single **cryptocurrency**. This can help protect your overall **investment** and potentially minimize losses during bear markets.

Another strategy is to **stay informed** about market trends and developments. By keeping up to date with news and analysis, you can make more **informed** decisions about when to buy or sell. Additionally, **technical analysis** can be a useful tool for identifying **trends** and potential **reversals** in the market.

It’s also important to **set realistic expectations** during bear markets. Prices may not **rebound** as quickly as during bull markets, so it’s essential to be patient and **avoid** making impulsive decisions. By **maintaining** a long-term perspective and **staying disciplined**, you can increase your chances of **success** in the cryptocurrency market.

Overall, navigating bear trends in cryptocurrency requires a **combination** of **strategies**, including diversification, **information** gathering, and **patience**. By **implementing** these approaches, investors can **better** position themselves to weather market downturns and potentially **capitalize** on opportunities that arise.

Analyzing the Impact of Market Sentiment on Crypto Cycles

When analyzing the impact of market sentiment on crypto cycles, it is crucial to understand how emotions and perceptions drive the trends in the cryptocurrency market. Market sentiment refers to the overall feeling or attitude of investors towards a particular asset or market. In the crypto space, market sentiment plays a significant role in shaping the direction of bull and bear trends.

During bull markets, positive market sentiment prevails as investors are optimistic about the future potential of cryptocurrencies. This optimism leads to increased buying activity, driving prices higher. On the other hand, bear markets are characterized by negative market sentiment, where investors are fearful or uncertain about the market’s direction. This fear often results in selling pressure, causing prices to decline.

Understanding market sentiment can help traders and investors anticipate market movements and make informed decisions. By analyzing social media, news articles, and market data, market sentiment indicators can be used to gauge the overall mood of the market. This information can be valuable in identifying potential trend reversals or shifts in market dynamics.

Strategies for Profiting from Bull and Bear Trends in Cryptocurrency

When it comes to profiting from bull and bear trends in cryptocurrency, there are several strategies that traders can employ to maximize their gains. By understanding the market cycles and knowing how to navigate through both bullish and bearish trends, investors can make informed decisions to capitalize on the volatility of the crypto market.

- Buy the Dip: One common strategy during a bull trend is to buy the dip, which means purchasing assets when their prices temporarily drop. This allows investors to acquire more coins at a lower price, increasing their potential profits when the market rebounds.

- Take Profits: It is essential to take profits during a bull trend to secure gains and mitigate potential losses. Setting profit targets and sticking to them can help investors lock in their earnings before the market turns bearish.

- Short Selling: During a bear trend, traders can profit by short selling cryptocurrencies, which involves borrowing assets and selling them at the current price with the intention of buying them back at a lower price in the future.

- Use Stop-Loss Orders: To protect against significant losses during a bear trend, investors can set stop-loss orders to automatically sell their assets if prices fall below a certain threshold. This helps limit potential damages and preserve capital.

By implementing these strategies and staying informed about market trends, traders can navigate through bull and bear cycles in the cryptocurrency market more effectively. It is crucial to remain disciplined, manage risks, and adapt to changing market conditions to succeed in the volatile world of cryptocurrencies.

Predicting Future Market Trends in the Crypto Industry

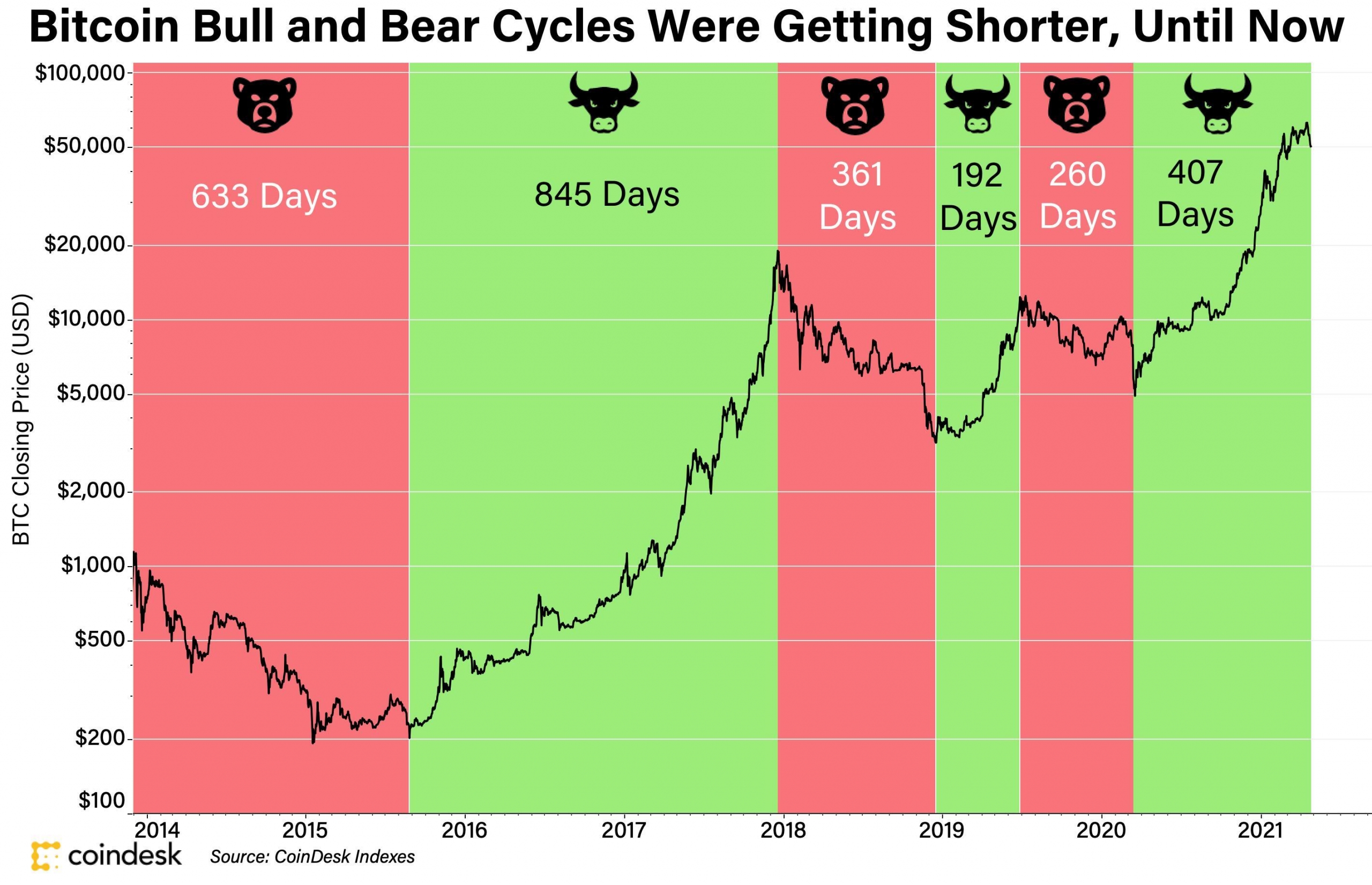

When it comes to predicting future market trends in the crypto industry, it is essential to analyze historical data and patterns. By examining past bull and bear cycles, analysts can gain insights into potential future movements. One key factor to consider is the overall market sentiment, which can heavily influence the direction of prices. Additionally, keeping an eye on regulatory developments and technological advancements can provide valuable clues about where the market may be headed.