The Role of Social Media in Crypto Market Trends

- Understanding the impact of social media on cryptocurrency prices

- How Twitter, Reddit, and other platforms influence market sentiment

- The rise of influencer marketing in the crypto space

- Analyzing the correlation between social media buzz and market volatility

- The role of social media in shaping investor behavior in the crypto market

- Exploring the potential risks and benefits of social media-driven market trends

Understanding the impact of social media on cryptocurrency prices

Social media plays a significant role in influencing cryptocurrency prices. Platforms like Twitter, Reddit, and Telegram are popular channels where investors discuss market trends, share news, and provide insights. The sentiment expressed on social media can have a direct impact on the buying and selling behavior of traders, leading to fluctuations in cryptocurrency prices.

One key aspect of social media’s influence on cryptocurrency prices is the concept of FOMO, or fear of missing out. When a particular cryptocurrency is being hyped up on social media, more investors may rush to buy it, driving up the price. Conversely, negative news or sentiments shared on social media can lead to a sell-off, causing prices to drop.

It is essential for investors to be aware of the influence of social media on cryptocurrency prices and to take information with a grain of salt. Not all information shared on social media is accurate or reliable, and it is crucial to conduct thorough research before making investment decisions based on social media trends.

How Twitter, Reddit, and other platforms influence market sentiment

Social media platforms such as Twitter, Reddit, and others play a significant role in influencing market sentiment, especially in the cryptocurrency space. These platforms serve as hubs for discussions, news sharing, and opinions on various crypto assets, which can have a direct impact on how investors perceive the market.

On Twitter, influential figures in the crypto industry often share their insights and thoughts on different projects, which can sway public opinion and ultimately affect market trends. Similarly, Reddit communities dedicated to cryptocurrencies can create a buzz around specific tokens or projects, leading to increased interest and investment.

Moreover, the real-time nature of social media allows for information to spread rapidly, causing sudden shifts in market sentiment. A single tweet or post can go viral, leading to a surge in buying or selling activity based on the reactions of the community.

It is essential for investors to be aware of the influence that social media platforms can have on market sentiment and to conduct thorough research before making any investment decisions based on information obtained from these sources. While social media can provide valuable insights, it is crucial to verify information and consider multiple sources to make well-informed choices in the volatile world of cryptocurrency trading.

The rise of influencer marketing in the crypto space

One of the key trends shaping the crypto market is the rise of influencer marketing. In recent years, influencers have played a significant role in shaping public opinion and driving investment in various cryptocurrencies. These influencers, who have large followings on social media platforms such as Twitter, YouTube, and Instagram, have the power to sway market trends and influence the decisions of retail investors.

By partnering with influencers, crypto projects can reach a wider audience and gain credibility in the eyes of potential investors. Influencers often promote new projects, tokens, or ICOs to their followers, creating hype and driving up demand. This can lead to significant price fluctuations and trading volumes in the crypto market.

However, influencer marketing in the crypto space is not without its risks. Some influencers may promote projects without disclosing their financial interests, leading to accusations of market manipulation. Additionally, the volatile nature of the crypto market means that investments based on influencer recommendations can be risky and unpredictable.

Despite these challenges, influencer marketing continues to play a significant role in shaping the crypto market. As the industry matures, regulators are beginning to crack down on deceptive practices and require influencers to disclose their relationships with crypto projects. This increased transparency is essential for building trust and credibility in the crypto space.

Analyzing the correlation between social media buzz and market volatility

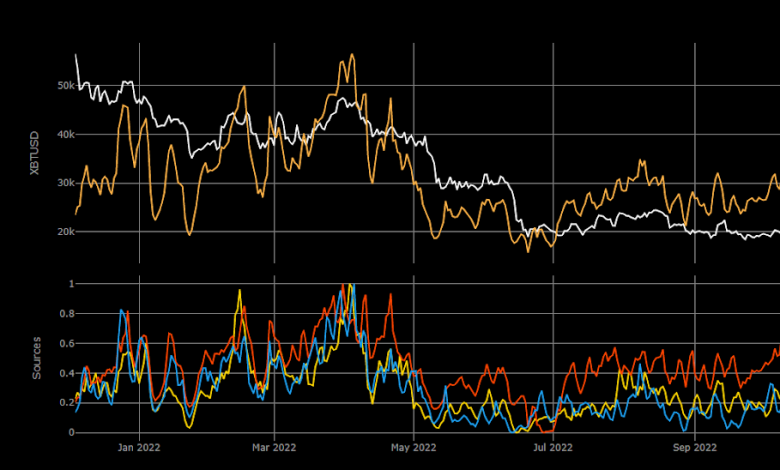

When it comes to understanding market trends in the crypto industry, analyzing the correlation between social media buzz and market volatility can provide valuable insights. Social media platforms have become a hub for discussions, news, and opinions related to cryptocurrencies, making them a rich source of data for market analysis.

By monitoring the sentiment and volume of conversations on social media platforms such as Twitter, Reddit, and Telegram, analysts can gauge the level of interest and excitement surrounding specific cryptocurrencies. This buzz can often translate into increased trading activity and price movements in the market.

Studies have shown that there is a strong correlation between social media activity and market volatility in the crypto space. When there is a surge in positive sentiment and mentions of a particular cryptocurrency on social media, it can lead to a spike in trading volume and price fluctuations. Conversely, negative news or discussions can trigger sell-offs and price drops.

It is essential for investors and traders to pay attention to social media trends and sentiment analysis to stay ahead of market movements. By leveraging tools and algorithms that can track and analyze social media data, market participants can make more informed decisions and potentially capitalize on emerging trends in the crypto market.

The role of social media in shaping investor behavior in the crypto market

Social media plays a significant role in influencing investor behavior in the cryptocurrency market. Platforms like Twitter, Reddit, and Telegram are popular channels where investors discuss market trends, share insights, and provide recommendations. The information shared on these platforms can have a direct impact on the buying and selling decisions of investors.

One of the key ways social media shapes investor behavior is through the spread of news and rumors. Information shared on social media platforms can quickly go viral, leading to a surge in trading activity. Investors often rely on social media influencers and popular figures in the crypto space to guide their investment decisions.

Moreover, social media platforms also serve as a source of market sentiment. By monitoring discussions and analyzing trends on these platforms, investors can gauge the overall mood of the market. Positive or negative sentiment can influence investor confidence and impact trading volumes.

It is essential for investors to exercise caution when relying on information from social media. While these platforms can provide valuable insights, they can also be sources of misinformation and hype. Conducting thorough research and verifying information from multiple sources is crucial to making informed investment decisions in the volatile crypto market.

Exploring the potential risks and benefits of social media-driven market trends

When it comes to social media-driven market trends, there are both risks and benefits to consider. On one hand, the power of social media to influence market behavior can lead to rapid and significant price fluctuations in the crypto market. This can create opportunities for traders to profit from short-term volatility. However, it also increases the likelihood of market manipulation and pump-and-dump schemes.

On the other hand, social media can also be a valuable source of information for investors looking to make informed decisions in the crypto market. By following influential voices and staying up-to-date on market trends, traders can gain insights that may help them anticipate price movements and identify profitable opportunities.

Ultimately, while social media can amplify market volatility and pose risks to investors, it also offers unique benefits in terms of access to information and opportunities for profit. Traders should approach social media-driven market trends with caution and critical thinking, balancing the potential rewards with the possible risks involved.