Crypto Asset Classification and Its Implications

- Understanding the Basics of Crypto Asset Classification

- The Importance of Properly Classifying Crypto Assets

- Regulatory Challenges in Crypto Asset Classification

- Implications of Misclassified Crypto Assets

- Investment Strategies Based on Crypto Asset Classification

- Future Trends in Crypto Asset Classification

Understanding the Basics of Crypto Asset Classification

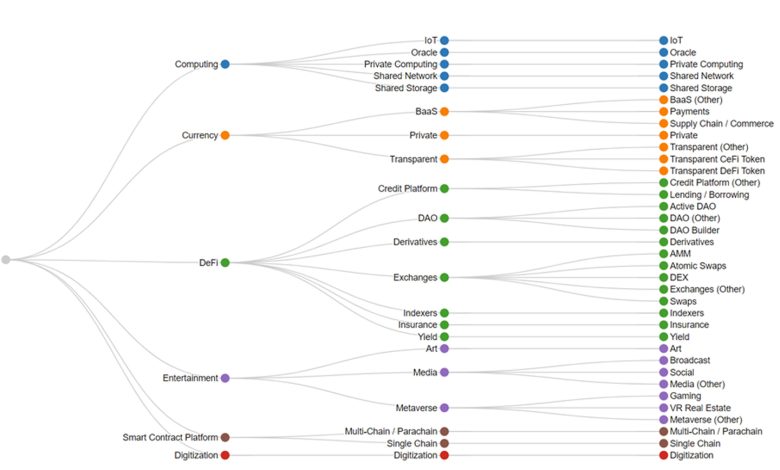

Crypto asset classification is a crucial aspect of understanding the diverse landscape of digital assets. By categorizing these assets based on their characteristics and functionalities, investors and regulators can better grasp their implications and risks. There are several key categories that crypto assets fall into, each with its unique features and use cases.

- Cryptocurrencies: These are digital currencies that operate on decentralized networks using blockchain technology. Bitcoin and Ethereum are prime examples of cryptocurrencies that serve as mediums of exchange and store of value.

- Tokens: Tokens represent a wide range of digital assets that can have various utilities within a specific ecosystem. They can be utility tokens used for accessing services or security tokens that represent ownership in a real-world asset.

- Stablecoins: Stablecoins are cryptocurrencies pegged to stable assets like fiat currencies or commodities to minimize price volatility. They provide a reliable medium of exchange and a hedge against market fluctuations.

- NFTs: Non-fungible tokens are unique digital assets that represent ownership of a specific item or piece of content. They have gained popularity in the art and gaming industries for their ability to prove ownership and authenticity.

Understanding the basics of crypto asset classification is essential for investors looking to diversify their portfolios and navigate the evolving regulatory landscape. By recognizing the distinct characteristics of each category, stakeholders can make informed decisions and mitigate potential risks associated with these innovative financial instruments.

The Importance of Properly Classifying Crypto Assets

Properly classifying crypto assets is crucial in the world of cryptocurrency due to the various implications it carries. By accurately categorizing digital assets, investors, regulators, and other stakeholders can better understand the nature of the crypto market and make informed decisions.

One of the key reasons why crypto asset classification is important is for regulatory compliance. Different jurisdictions have varying rules and regulations regarding cryptocurrencies, depending on how they are classified. Therefore, ensuring that crypto assets are correctly categorized can help avoid legal issues and penalties.

Moreover, proper classification can also impact taxation of crypto assets. Depending on how a digital asset is classified, it may be subject to different tax treatments. By accurately determining the classification of crypto assets, individuals and businesses can ensure they are fulfilling their tax obligations correctly.

Additionally, crypto asset classification can affect investment strategies. Different types of cryptocurrencies have varying levels of risk and return potential. By understanding the classification of crypto assets, investors can make more informed decisions about where to allocate their funds.

In conclusion, the importance of properly classifying crypto assets cannot be overstated. It impacts regulatory compliance, taxation, and investment decisions. Therefore, stakeholders in the cryptocurrency market must pay close attention to how digital assets are categorized to navigate the evolving landscape effectively.

Regulatory Challenges in Crypto Asset Classification

When it comes to regulatory challenges in crypto asset classification, there are several key issues that need to be addressed. One of the main challenges is the lack of uniformity in how different countries classify crypto assets. This lack of consistency can create confusion for investors and businesses operating in the cryptocurrency space.

Another regulatory challenge is the rapidly evolving nature of crypto assets. As new types of cryptocurrencies are developed, regulators struggle to keep up with the pace of innovation. This can lead to uncertainty in how crypto assets should be classified and regulated.

Additionally, the global nature of cryptocurrencies presents a challenge for regulators. Because crypto assets can be transferred across borders with ease, it can be difficult for regulators to enforce regulations on a global scale.

Implications of Misclassified Crypto Assets

When crypto assets are misclassified, it can have significant implications for investors, regulators, and the overall market. Misclassification can lead to confusion and uncertainty, as investors may not fully understand the risks associated with a particular asset. This lack of clarity can result in misinformed investment decisions and potential financial losses.

Regulators also face challenges when crypto assets are misclassified. Without accurate classification, it becomes difficult to enforce regulations and protect investors from fraudulent activities. Additionally, misclassification can hinder the development of clear guidelines for market participants, creating a regulatory environment that is uncertain and potentially harmful to market integrity.

Furthermore, misclassified crypto assets can distort market data and misrepresent the true value of different assets. This can lead to market inefficiencies and distortions, as investors may be misled by inaccurate information. In extreme cases, misclassification can contribute to market manipulation and instability, further eroding trust in the crypto market.

Investment Strategies Based on Crypto Asset Classification

When it comes to investment strategies based on crypto asset classification, it is essential to understand the different categories of cryptocurrencies and how they can impact your investment decisions. By categorizing crypto assets into groups based on their characteristics and use cases, investors can develop a more targeted approach to building a diversified portfolio.

One common investment strategy is to allocate a portion of your portfolio to each crypto asset class to spread risk and maximize potential returns. For example, you may choose to invest in store of value cryptocurrencies like Bitcoin as a hedge against inflation, while also allocating funds to utility tokens for access to specific platforms or services.

Another investment strategy based on crypto asset classification is to focus on emerging trends within the industry. By identifying which crypto asset classes are gaining traction and have the potential for growth, investors can capitalize on opportunities early on and potentially generate higher returns.

It is important to note that investment strategies based on crypto asset classification should be tailored to your risk tolerance, investment goals, and time horizon. Diversification across different crypto asset classes can help mitigate risk and improve the overall performance of your portfolio.

Future Trends in Crypto Asset Classification

The future trends in crypto asset classification are crucial to understand as the market continues to evolve rapidly. One key trend is the increasing regulatory scrutiny on crypto assets, which is leading to more standardized classification frameworks. This will help investors better assess the risks and opportunities associated with different types of crypto assets.

Another trend to watch is the growing popularity of decentralized finance (DeFi) tokens, which are challenging traditional asset classifications. These tokens often blur the lines between securities, commodities, and currencies, making classification more complex. As regulators grapple with how to classify these assets, investors must stay informed to navigate this rapidly changing landscape.

Additionally, the rise of non-fungible tokens (NFTs) is reshaping the way we think about asset classification. These unique digital assets represent ownership of digital art, collectibles, and more, raising questions about how to classify them. As NFTs gain mainstream adoption, regulators will need to provide clarity on how to classify these assets to ensure investor protection and market stability.

Overall, staying informed about the latest trends in crypto asset classification is essential for investors looking to navigate this dynamic market. By understanding the implications of these trends, investors can make more informed decisions and mitigate risks in their crypto asset portfolios. As the market continues to evolve, staying ahead of these trends will be key to success in the crypto asset space.